FINANCIAL ONLY SERVICES

Professional Association Accounting Without the Full Management Package

Here’s a situation we see all the time: a community association has solid volunteers running things. The board handles vendor relationships well. Architectural reviews get processed. Maintenance gets coordinated. Residents get responses to their questions. The operational side works. Then someone asks to see the latest financial statements, or it’s time to prepare the annual budget, or a few homeowners are months behind on assessments—and suddenly everyone realizes the financial management piece isn’t working nearly as well as everything else. That’s exactly when communities start looking for financial-only services.

Your community might not need complete management. Maybe your board’s doing fine with day-to-day tasks. Volunteers handle architectural reviews, coordinate maintenance, and deal with resident questions. That part’s working. But the financial side? That’s where things get tricky.

HOA finances have layers most people don’t think about until they’re in the middle of it. There are compliance issues. GAAP standards you need to follow. Audit requirements. Reserve fund regulations that vary by state. Miss something in how you’re handling delinquencies or put together your budget wrong, and you’re looking at legal problems or financial trouble that’s hard to dig out of.

Financial-only services let you keep doing what’s working while bringing in professionals for the accounting piece. Your board stays in control. We handle the money side.

What You're Actually Getting

Budget Preparation and Planning

Building an HOA budget isn’t like doing a household budget. You can’t just look at what you spent last year and add five percent. Your governing documents probably have requirements about what needs to be funded. Your state likely has laws about reserve contributions. You’ve got capital projects coming up that need to be planned for. Insurance costs that keep climbing. Maintenance contracts that are up for renewal.

We start by working backward from when your fiscal year ends to figure out a timeline that won’t have everyone panicking at the last minute. We build templates that make tracking income and expenses throughout the year actually manageable. We review your governing documents and state regulations to identify requirements that are easy to miss if you don’t do this regularly. By the time budget season shows up, you’ve got a process that works instead of people scrambling to throw numbers together.

Accounts Receivable and Collections

Getting people to pay their assessments should be simple. Send a bill, people pay it. Except that’s not how it goes. People forget. People hit financial rough patches. Some people just decide they’re not paying and dare you to do something about it.

If you don’t have a solid collections process—and it needs to be both consistent and legally compliant—small problems can turn into big ones fast. A few people not paying turns into a bunch of people not paying because word gets around that nobody’s enforcing it. Your budget falls apart because you were counting on assessment income that’s not coming in.

We stay on top of delinquency reports. Send notices that follow both your governing documents and state law—which aren’t always the same thing, by the way. When notices aren’t working, we bring in collection specialists who know how to handle this stuff properly. Your association stays financially healthy. Board members don’t end up being the bad guys chasing neighbors for money, which is how friendships and board participation die.

Accounts Payable Processing

Paying bills sounds basic until you’re the one responsible for it in an HOA. Board members need to see what’s being paid and have enough detail to know it’s legitimate. Homeowners sometimes ask questions about where their fees are going, especially when assessments go up. If you can’t quickly show people what’s being spent and why, those questions turn into complaints and mistrust.

We process accounts payable with complete visibility. Board members get full autonomy to view and approve each invoice with the click of a button, our team identifies where this should be coded, and that it’s paid on time. Board members can view account balances at any time, and review past invoices easily. Homeowners ask, ‘Where’s the money going?’ There are clear records to show them. Nobody’s digging through boxes of paper receipts or forwarding email chains trying to reconstruct what happened three months ago.

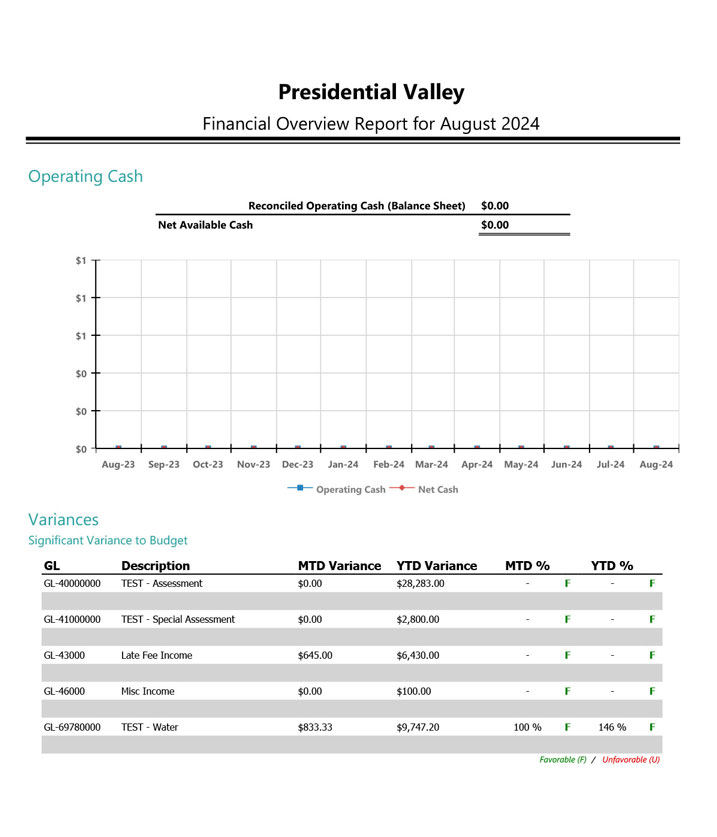

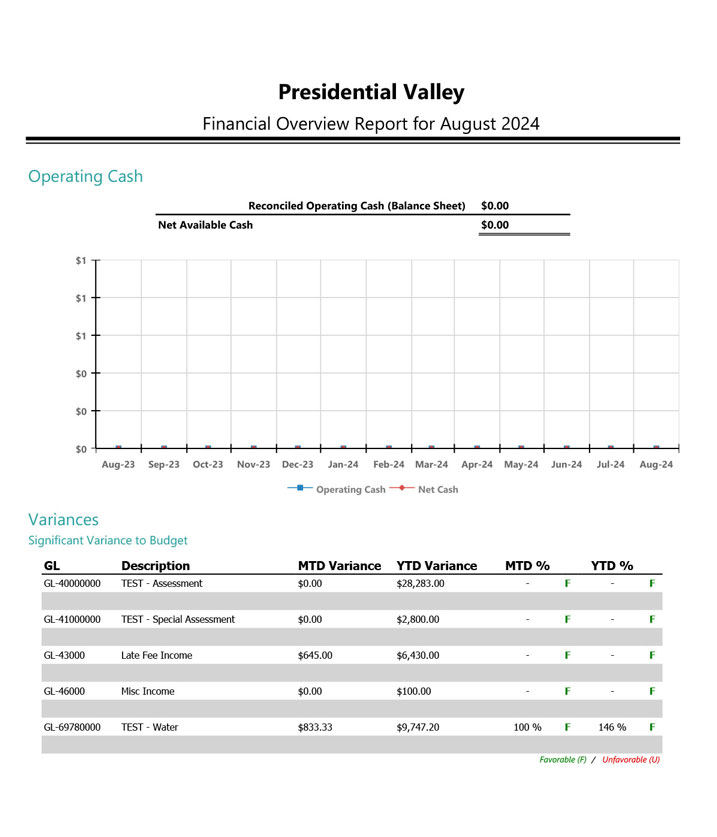

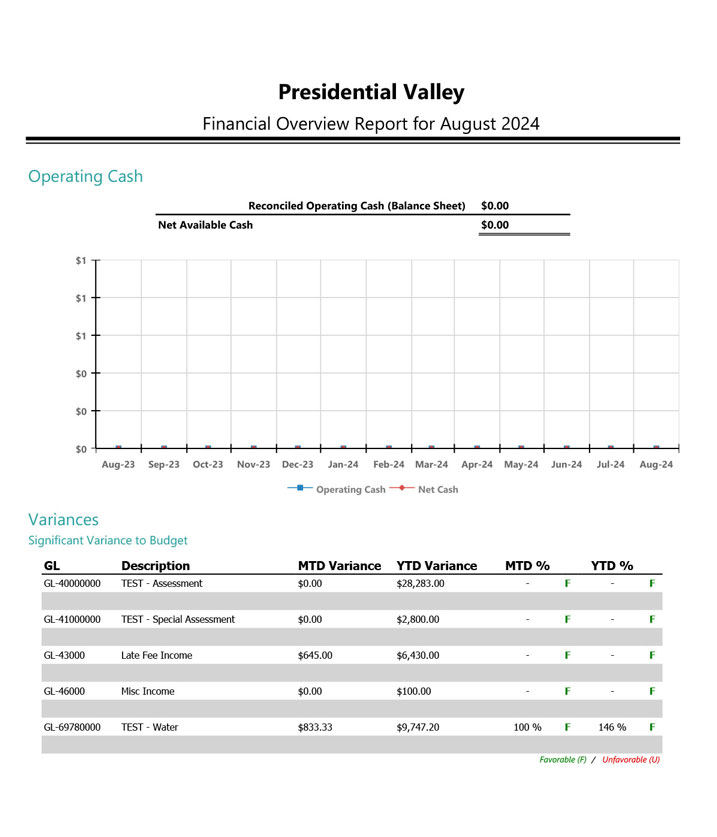

Monthly Financial Statements

Board members need to see what’s happening with association money. Not just once a year—regularly, so they can catch problems early and make informed decisions. But standard business financial statements don’t really work for HOAs because reserve funds must be tracked separately from operating funds.

We produce monthly financial statement packages using fund reporting accounting. Operating funds and reserve funds are clearly separated so board members can see what’s happening in each area. These statements are built for HOA accounting, not just generic business financials. When boards need to share financial information with homeowners, the reports are clear enough that non-accountants can actually understand them.

Tax and Audit Support

HOA tax returns are their own special thing. If you’ve been having your regular CPA do them, they might be figuring it out as they go, which means you’re paying them to learn on your dime. If a board member’s been handling it, they’re probably spending way more time on it than necessary and worrying whether they’re doing it right.

Same thing with audits. HOA audits have specific requirements that general accountants don’t necessarily know. Our team navigates HOA tax returns and audit prep constantly. We work with local CPAs who specialize in association accounting. When tax season hits or it’s time for an audit, we handle the preparation. Your board doesn’t spend weeks stressed about forms and deadlines.

When Financial-Only Makes Sense

Communities end up wanting financial-only services for different reasons. Sometimes boards want to stay hands-on with operations but recognize they’re in over their heads with the financial piece. Maybe you’ve got retired teachers and engineers on your board who are great at solving problems but haven’t done accounting since college, if ever.

Other times, a community tried going fully self-managed, and it mostly worked except for the money side. Handling maintenance and architectural stuff? Fine. Building a compliant budget and managing collections properly? That’s turning into a disaster.

Some associations are coming off full management and want to self-manage operations, but keep professional eyes on finances. You know you can coordinate vendors and handle resident issues. You also know that HOA accounting has specialized requirements that require someone who does this for a living.

And sometimes the previous financial situation was so messy that you need professionals to come in, fix what’s broken, and set up systems that actually work going forward. Records are incomplete. The budget’s been wrong for years. Collections have been handled randomly or not at all.

What Changes When Finances Get Handled Right

You notice when financial management is working properly. The budget reflects what’s actually happening rather than wishful thinking. Reserves are being funded at appropriate levels, so when a major expense comes up, there’s money to cover it rather than panic and a special assessment.

Collections are consistent and follow the rules, which keeps the association solvent and treats everyone fairly. Board members can answer homeowner questions about finances because they’ve got reports that make sense and information that’s easy to access.

Compliance doesn’t keep you up at night. GAAP standards are being followed, and governing document requirements are met. State regulations about reserve studies and funding are handled. When audit time rolls around, everything’s organized and ready, not a scrambled mess of incomplete records.

Board members spend their time on actual governance—making decisions about the community’s future—instead of trying to teach themselves accounting software, figure out collection laws, or stress about whether they’re handling taxes correctly. Volunteers can focus on what they’re actually good at through our Board Member Experience®.

How We Keep Financial Information Accessible

HOA finances need to be transparent, but there’s a balance to strike. Board members need detail so they can make good decisions and fulfill their fiduciary duty. Homeowners want to know their money’s being managed responsibly without having to become accountants themselves. Nobody should have to spend hours hunting through files to find out what happened or why a decision was made.

Financial records are stored in our cloud system, where board members can access them whenever needed. Want to see what happened two years ago? It’s there. New people join the board and need to get up to speed? Historical records are available so that they can see the full picture. Homeowners ask questions about spending. There are clear reports that explain it without requiring a degree in accounting to understand.

We build transparency into how the whole system works from the beginning, not as an afterthought because someone complained.

Setting Up Financial Services

Getting this started isn’t complicated through our onboarding process. We need your current financial records—whatever state they’re in, we’ll work with it. We review your governing documents to understand your association’s specific requirements. We set up our systems to match what your community needs.

With our Financial Only Services, your board maintains control of operations as usual, while we streamline your financial management.

What we handle:

- Core Accounting & Reporting: We take over accounting, ensuring you receive regular, accurate financial statements and comprehensive compliance management.

- Cash Flow Management: We facilitate the essential tasks of paying bills and collecting assessments.

- Budgeting Support: During budget season, we provide all the necessary support and templates.

- Compliance & Auditing: Our team covers tax time and audit preparation.

Your board retains all decision-making power over spending. We focus on executing the financial management properly and ensuring it remains compliant.

Ready to Talk About Your Community's Finances?

If your association needs professional financial management but you don’t want to hand over full operational control, this is what we do. Your board keeps running day-to-day operations through our team-based approach. We handle the specialized accounting work.

Contact us to talk through how financial-only services would work for your specific situation. We’ll assess your association’s needs and put together a customized solution that provides the right level of financial support.